The Ultimate Guide to Forex Trading Practice

The Ultimate Guide to Forex Trading Practice

Forex trading can be a daunting endeavor for newcomers, but with adequate practice and a structured approach, anyone can build the skills necessary for success. In this guide, we will delve into various aspects of forex trading practice, from understanding market mechanics to developing sound strategies. Whether you’re a seasoned trader or just getting started, the insights provided here will help you enhance your trading journey. Don’t forget to check out forex trading practice Qatar Brokers for exceptional trading options.

Understanding the Forex Market

The foreign exchange market is the largest financial market in the world, with a trading volume exceeding $6 trillion a day. Unlike stock trading, forex operates 24 hours a day, allowing traders to engage in the market at any time. It consists of currency pairs, where one currency is exchanged for another, and the valuation is always relative to the currency it is paired with.

The Importance of Practice in Forex Trading

Just like any other form of trading or investment, practice is essential in mastering forex trading. Simulation and practical application can help traders understand the market dynamics, develop strategies, and improve their decision-making skills. Here are a few reasons why practice is paramount in forex trading:

- Builds Confidence: Trading in a simulated environment helps reduce anxiety and builds the confidence necessary for real-world trading.

- Refines Strategies: Practicing helps traders fine-tune their strategies, enabling them to identify what works best for their trading style.

- Enhances Market Understanding: Continuous practice helps traders stay updated with market trends, improving their analytical skills.

- Reduces Emotional Trading: Practicing can help traders develop discipline, aiding them in controlling their emotions during live trading sessions.

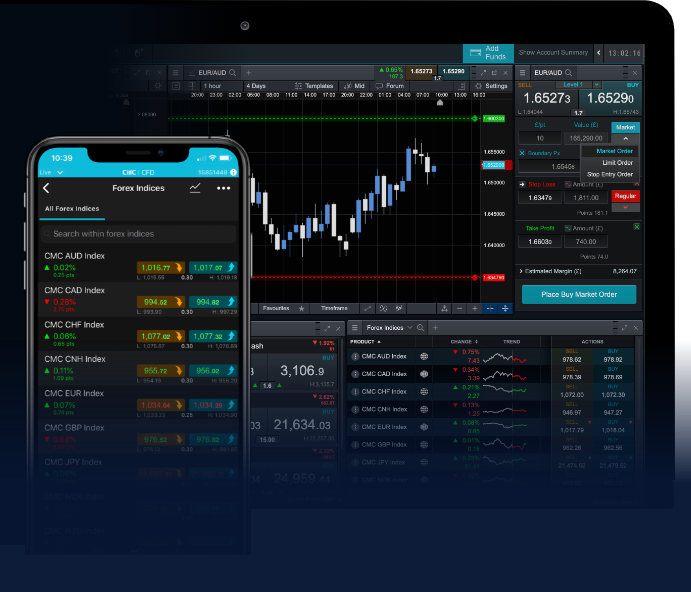

Choosing the Right Trading Platform

Selecting a reliable trading platform is critical to your trading success. A good platform provides analytical tools, ease of use, and fast execution times. Some popular trading platforms for forex trading include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Before you start practicing, make sure that your chosen platform offers a demo account. This allows you to trade risk-free and replicate market conditions without the need for initial capital.

Developing a Trading Strategy

Every successful trader has a well-defined trading strategy that guides their decisions. Here are some elements to consider when developing your strategy:

- Define Your Goals: Identify your financial goals and trading performance metrics. Are you aiming for short-term profits, or are you interested in long-term investment?

- Choose the Right Currency Pairs: Focus on a few currency pairs that you’re comfortable with and understand well. Major pairs like EUR/USD, GBP/USD, and USD/JPY are good starting points.

- Select Analysis Methods: Decide whether you will use technical analysis, fundamental analysis, or a combination of both to inform your trading decisions.

- Risk Management: Develop a risk management plan that outlines how much capital you are willing to risk on each trade. This should include setting stop-loss and take-profit orders.

Utilizing Demo Accounts

A demo account is an invaluable tool for forex traders. It provides a simulated trading environment that closely mirrors real market conditions. Here are a few key benefits of using a demo account:

- Zero Financial Risk: You can practice trading without the risk of losing real money, allowing you to test various strategies without the pressure of financial consequences.

- Learning Tools: Most demo accounts come equipped with educational resources. Take advantage of these tools to enhance your trading knowledge.

- Familiarization with the Platform: Use this opportunity to familiarize yourself with the trading platform, understanding its functionalities, and interacting with its features.

- Experimenting: Feel free to experiment with different trading styles and approaches to find what works best for you.

Staying Informed About Market Trends

The forex market is influenced by various global economic factors, and staying updated is crucial. Regularly check financial news, economic reports, and geopolitical events that might affect currency values. Many traders follow economic calendars that outline critical upcoming events, including interest rate announcements, employment reports, and inflation figures, that can impact currency trading.

Analyzing Your Trading Performance

Keeping a trading journal is a practice that can greatly benefit your forex journey. Documenting each trade’s details—entry/exit points, reasoning behind the trade, outcomes, and emotions experienced during trading—can help you analyze your performance over time. Regularly reviewing this journal can highlight areas for improvement and strategies that yield the best results.

Emotional Control in Trading

One of the most challenging aspects of trading is managing emotions. Fear and greed can cloud judgment, leading to impulsive decisions that may harm your trading outcomes. Practicing mindfulness, setting realistic expectations, and adhering to your trading plan can significantly reduce the emotional weight of trading. Understanding the psychological aspects of trading will enable you to remain disciplined, even in volatile market conditions.

The Path to Becoming a Successful Trader

Becoming a successful forex trader requires time, patience, and continuous practice. Understand that losses are part of the process, and don’t let them deter your commitment. Maintain a learning mindset, and continuously seek to improve your trading strategies and skills. Engaging with communities, forums, or mentorship programs can provide additional insights and strategies to help you refine your trading approach.

Conclusion

Forex trading practice is essential for skill development and achieving success in the financial markets. By leveraging demo accounts, developing strategies, employing risk management, and continuously educating yourself, you can enhance your trading skills significantly. Remember, every trader’s journey is unique. Allocate time for practice, and soon enough, you’ll find yourself navigating the forex market with confidence and competence.